Accordingly, under FIFO method, goods purchased recently form a part of the closing inventory. Gross Profit is an important metric as it indicates the efficiency with which your business operates. It lets you know cost of goods sold how efficiently your business is utilising its labour and raw materials to manufacture its finished products. Beginning inventory is nothing but the unsold inventory at the end of the previous financial year.

How to Calculate Cost of Goods Sold (COGS)

Before you can begin looking into your business’s profit, you need to understand and know how to calculate cost of goods sold (COGS). Start here by learning all about COGS, including the cost of goods sold formula and what you can use it for. Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position. For example, there is a double effect of inventory on both accounts, i.e. on the balance sheet and profit and loss account.

Calculations of Costs of Goods Sold, Ending Inventory, and Gross Margin, First-in, First-out (FIFO)

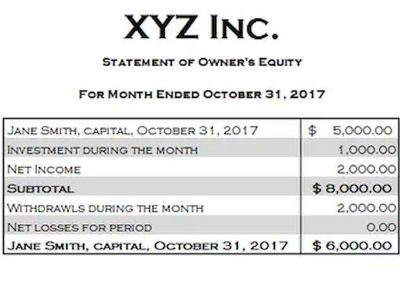

If COGS is not listed on a company’s income statement, no deduction can be applied for those costs. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). The IRS requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory. Depending on the business’s size, type of business license, and inventory valuation, the IRS may require a specific inventory costing method. However, once a business chooses a costing method, it should remain consistent with that method year over year.

Operating Expenses vs. COGS

Currently, Garth holds a $12,000 share in the business, a little shy of half its total equity. For Where’s the Beef, let’s say you invested $2,500 to launch the business last year, and another $2,500 this year. You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- No matter how COGS is recorded, keep regular records on your COGS calculations.

- Also, managers may pay close attention to its COGS, as they can lower this cost as much as possible to record higher margins.

- Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- If inventory decreases by 50 units, the cost of 550 units is the COGS.

- The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers.

By tracking such a figure for a host of companies, they can know the cost at which each of the companies is manufacturing its goods or services. Thus, if one company is manufacturing goods at a low price as compared to others, it certainly has an advantage as compared to its competitors as more profits would flow into the company. Therefore, the lesser the ratio, the more efficient is your business in generating revenue at a low cost. That is to say that the decreasing COGS to Sales ratio indicates that the cost of producing goods and services is decreasing as a percentage of sales. Calculating the cost of goods sold can become a lengthy and tedious process.

Why You Can Trust Finance Strategists

Examples of businesses using the cost of sales are business consultants, attorneys, and doctors. The balance sheet has an account called the current assets account. The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory.

- The terms ‘profit and loss account’ (GAAP) and ‘income statement’ (FRS) should reflect the COGS data.

- This means that the balance sheet should always balance, hence the name.

- Cash equivalents are very safe assets that can be readily converted into cash; U.S.

- However, the salary of the CEO would not be included, as he or she is not directly involved in production.

- Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity).

- Lastly, inventory represents the company’s raw materials, work-in-progress goods, and finished goods.